Talk about tariffs continue to pound the news headlines day after day. Taxing imports on goods from other countries such as Canada, Mexico, and China have potential economic impacts that can be troubling for financial markets. These include slower economic growth and the potential for recession as well as rising prices and the threat of high inflation. Amid the turbulence, we have no shortage of experts talking with alarming tones on the details and nuances of exact how these tariffs will turn markets upside down from autos to avocados. It is understandable for many investors to get caught up in the maelstrom of the daily tariff news flow, particularly when it comes with wider financial market swings as of late. But instead of becoming overwhelmed in the talk about tariffs, investors are better served to listen to the music being played by the market itself to best understand how things will ultimately play themselves out.

“Don’t you feel it growing, day by day

People getting ready for the news

Some are happy, some are sad

Oh, we got to let the music play”

-Listen To The Music, The Doobie Brothers, 1972

The music of the markets. “Price is truth” is a saying associated with financial markets. What does this mean? That the market price of an asset such as stocks or bonds is the most accurate reflection of its true value that includes all of the talk and noise that may be surrounding these assets at any given point in time. In short, instead of comparing and contrasting the views of the so many “experts” about tariffs and what they mean, the most reliable measure of the true impact is to focus on market prices themselves.

So what is the “truth” that stock prices are telling us today about tariffs. The good news is that financial markets remain far more sanguine about the tariff news than what the headlines might suggest.

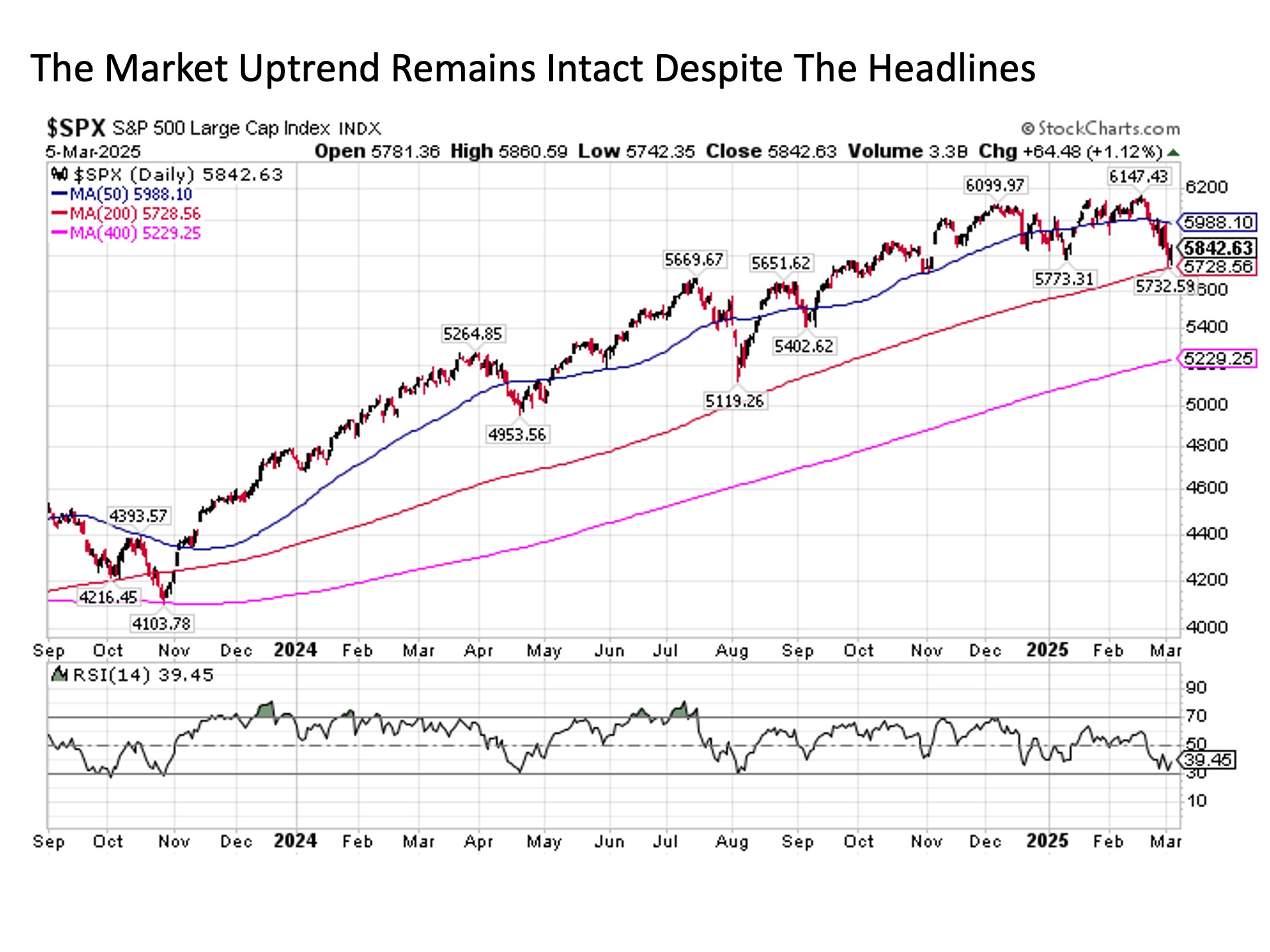

Let’s start with a look at the headline benchmark S&P 500 Index. Have tariffs caused price swings to pick up on the S&P 500 recently? Sure. But we must pull back from the “tree” of whether the S&P is swinging sharply up or down on any given trading day and instead look at the broader “forest” of how the S&P has performed over the last many weeks and months that have led us to this point. And a broader visual look at prices reveal a far more reassuring picture about how markets are viewing the tariff situation so far.

Yes, the S&P 500 has fallen by more than -6% peak to trough over the last couple of weeks. But this last “couple of weeks” period started with the S&P 500 hitting fresh new all-time highs on February 19 at 6147. So while the recent price decline feels sharp and kind of panicky, it has done nothing more than bring stocks back to levels that represented all-time highs as recently as September. And this is in the context of a market where if you asked investors this time last year whether the S&P 500 would be trading within striking distance of 6000 much less more than 100 points above it along the way, most would have considered this a stretch.

Let’s dig a little deeper into the above chart. The recent decline in the S&P 500 has been nothing more than a long overdue garden variety pullback amid a still persistently strong bull market in stocks. And recent declines have been very orderly from a technical perspective.

Why overdue? Because prior to the recent stock price volatility that stretches back to last Thanksgiving despite hitting new all-time highs less than two weeks ago, stocks had been doing nothing other than going straight up for a long, long time. After bottoming at around 4100 around Halloween in 2023 (repeat – 2023), the S&P 500 jumped by roughly +50% over the next year with only two minor blips along the way – a tough first two weeks in April and a few bumpy days at the end of July and the beginning of August. Otherwise, stocks were rising relentlessly. This is not how a normal market behaves, as typical bull markets move in a two to three steps forward, one step back oscillating manner. So the fact that stocks have been enduring some turbulence not only in recent weeks but since Thanksgiving is actually a healthy thing, as it means some of the froth accumulated during the recent rise in stocks is being worked off of the market.

How orderly? Let’s zoom in and focus on the smooth red line in the chart above. This is the 200-day moving average for the S&P 500, which is a long-term trendline for the headline index. This has been rising with a notably steep slope for well over a year. Over time, prices typically will either rise up or fall back to these moving average trendlines like gravity. And since the last market peak on February 19, the S&P 500 has done nothing more than fall back to its 200-day moving average. This is referred to as “support” and is where we look for stock prices to bounce after a recent fall. And no sooner did the S&P 500 fall to its 200-day moving average support at around 5730 then it subsequently bounced by more than 110 S&P points through Wednesday’s close.

Could the S&P 500 go on to eventually fall below this key 200-day moving average support level in the coming trading days? Absolutely, and investors remain well served as always to monitor market events closely as they unfold. But to this point, markets have been behaving very well and orderly so far amid all of the recent tariff turbulence.

“What the people need

Is a way to make ‘em smile”

-Listen To The Music, The Doobie Brothers, 1972

What about the fundamentals? OK. That’s fine and good that the market music still feels good. But what about the fundamentals. Are conditions deteriorating? Is it only a matter of time before stocks succumb to a more disconcerting underlying reality that may be accumulating because of what is taking place with tariffs? Once again, prices is truth.

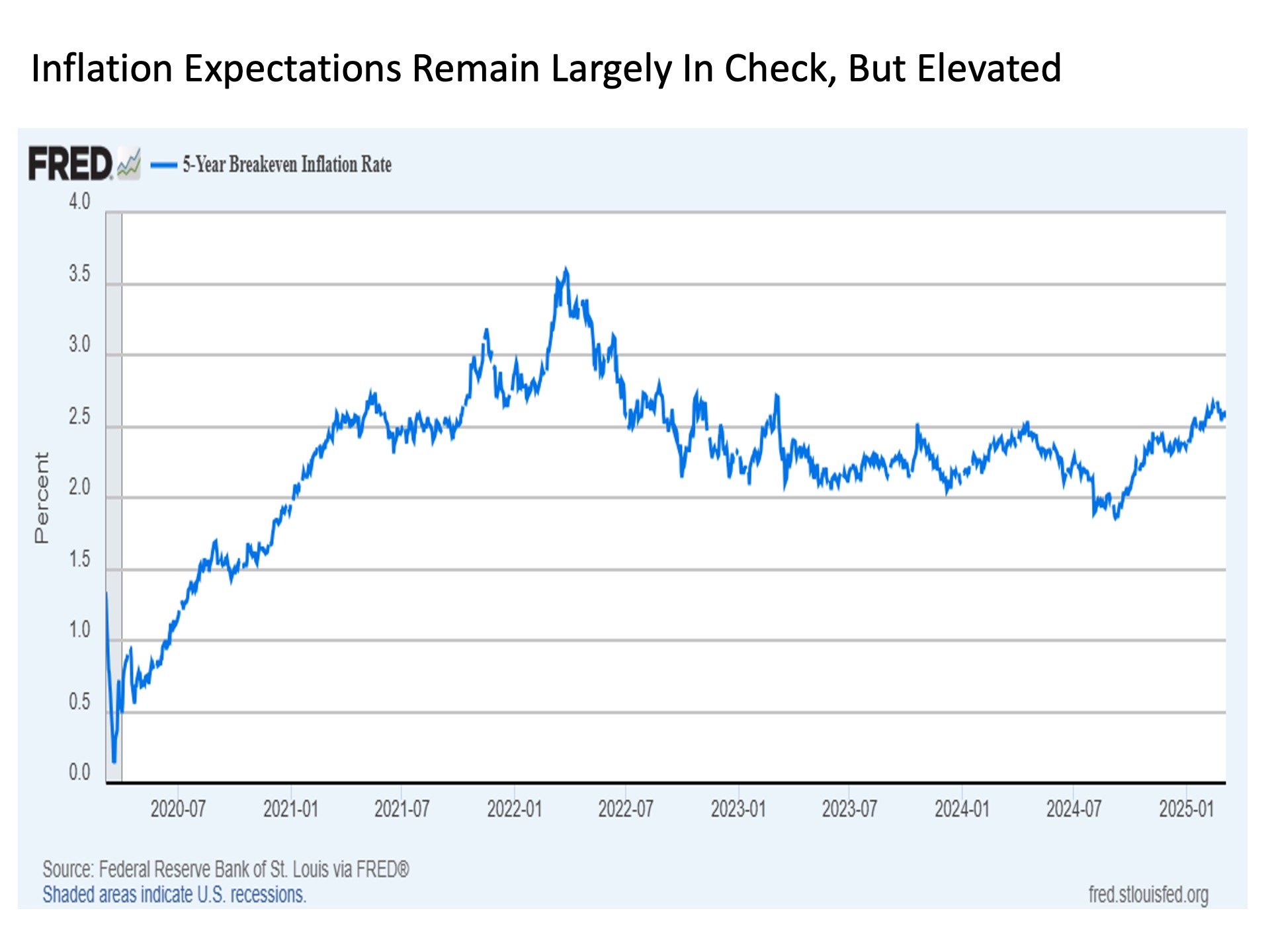

Let’s revisit the key worries associated with the various tariffs being thrown around lately. Let’s start with inflation. Indeed, tariffs are something that often will cause prices to go up. But while many pundits may be pontificating about the inflationary effects, prices in the market think otherwise. Consider the chart of the 5-Year Breakeven Inflation rate shown below. This is a measure of what the market is pricing in for average inflation over the next five years.

The good news here is that inflation expectations remain in check despite all of the tariff news. While they are a bit elevated, particularly compared to where we were last September, at 2.56% today they remain largely subdued. Moreover, it’s notable that inflation expectations have actually recently fallen from a recent peak of 2.66% when the market was peaking a couple of weeks ago. Put simply, if the recent market pullback had anything to do with concerns about tariffs causing inflation, the market is telling the exact opposite story. This is one way to make investors smile.

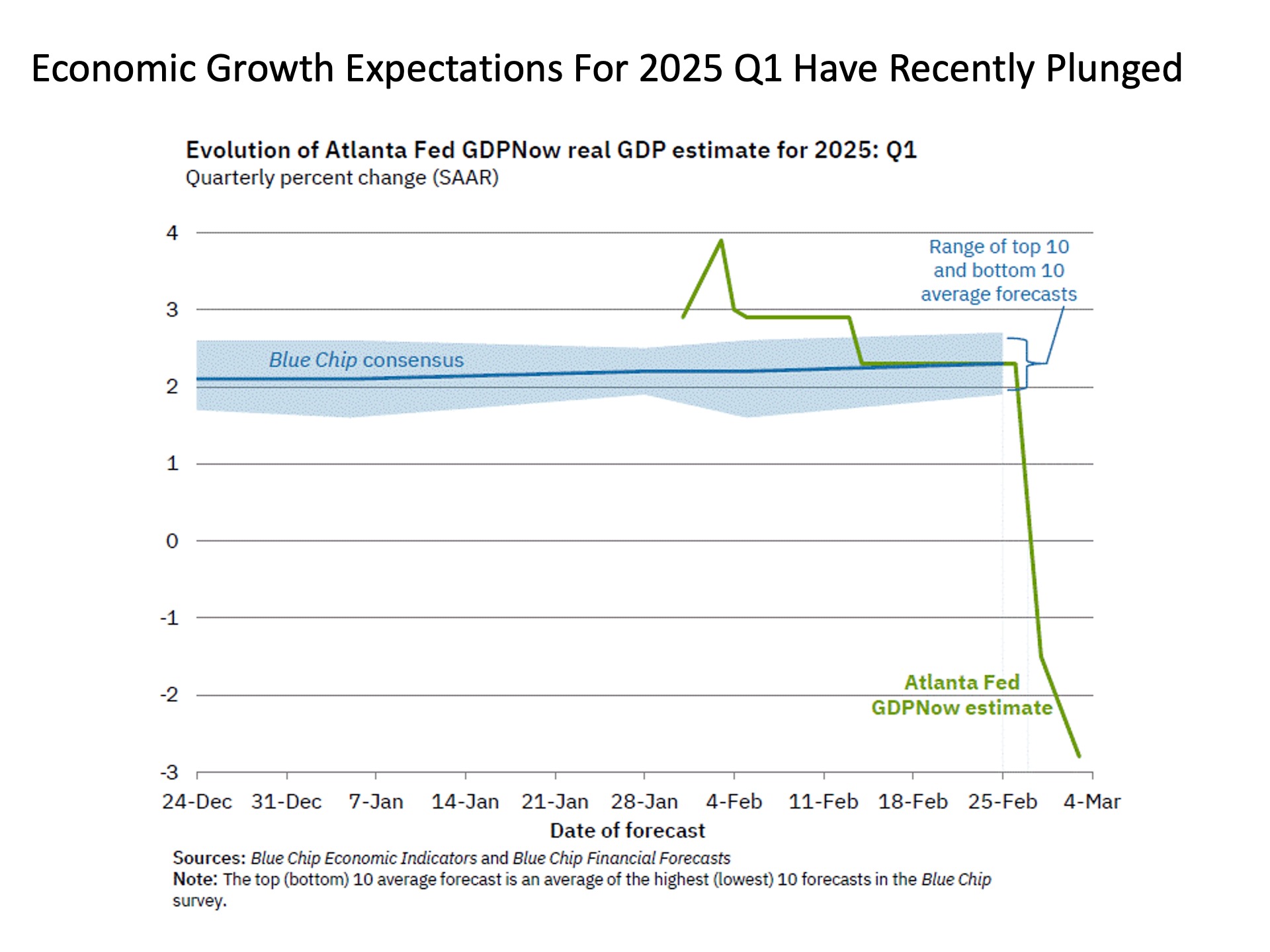

Let’s move on to the next key topic, which is economic growth. Here we see a notable recent bump in the road. According to the Atlanta Fed GDPNow forecast, which is a statistical model based on most recent economic data, the forecast for 2025 Q1 has plunged from solidly positive above +2% to decidedly negative approaching -3%. Yikes! But let’s take a beat and consider this a bit further.

First, the technical definition of an economic recession is two consecutive quarters of negative GDP growth. While the precipitous drop in the chart above does grab the attention, a one week drop in the forecast for one quarter’s GDP is a far cry from actually putting two negative quarters (six months) of real economic contraction officially in the books. Should we continue to monitor this recent development? Absolutely. But it’s not anything that should signal the alarm bells at this time.

Next, we return to our notion that price is truth. The Atlanta Fed GDPNow forecast is a quantitative model based on economic data, not market prices. So what are market prices telling us right now. That’s is all pretty much good.

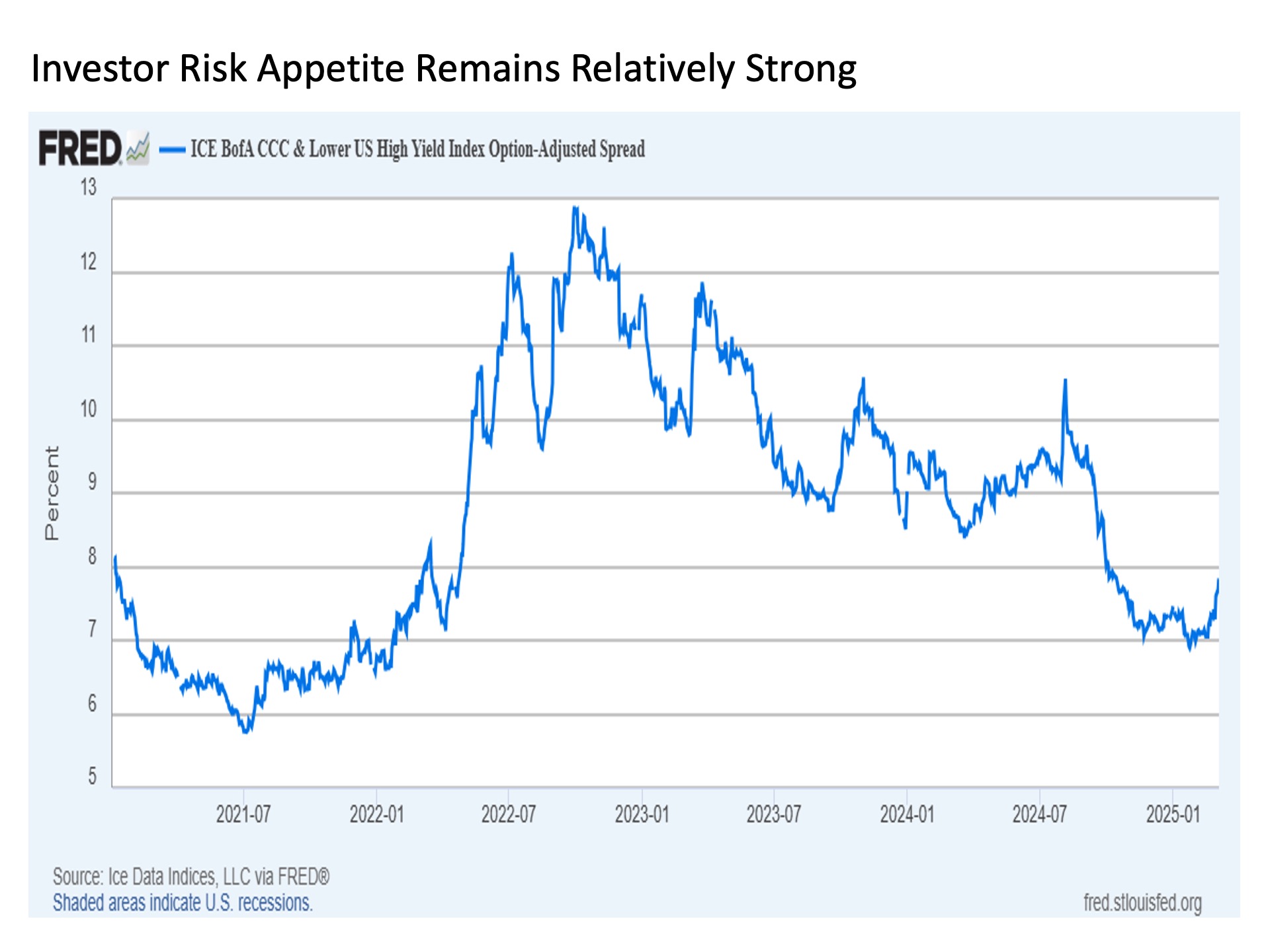

Consider as just one of many examples the yield spread that investors are requiring above comparably dated U.S. Treasuries for taking the extreme risk of owning CCC or lower rated high yield corporate bonds. In short, these are the bonds that are most likely to evaporate first with the onset of any future recession.

The good news here is that CCC spreads remain near their lowest levels in more than three years, indicating that investors are comfortable with being paid less to take on the risk of owing the worst quality bonds in the marketplace today. This suggests that the market is not pricing in recession risks, at least right now.

Have CCC spreads creeped up recently? Sure, but they remain percentage points below where they were back a few months ago in August, and the economy has certainly held up fine in the months since.

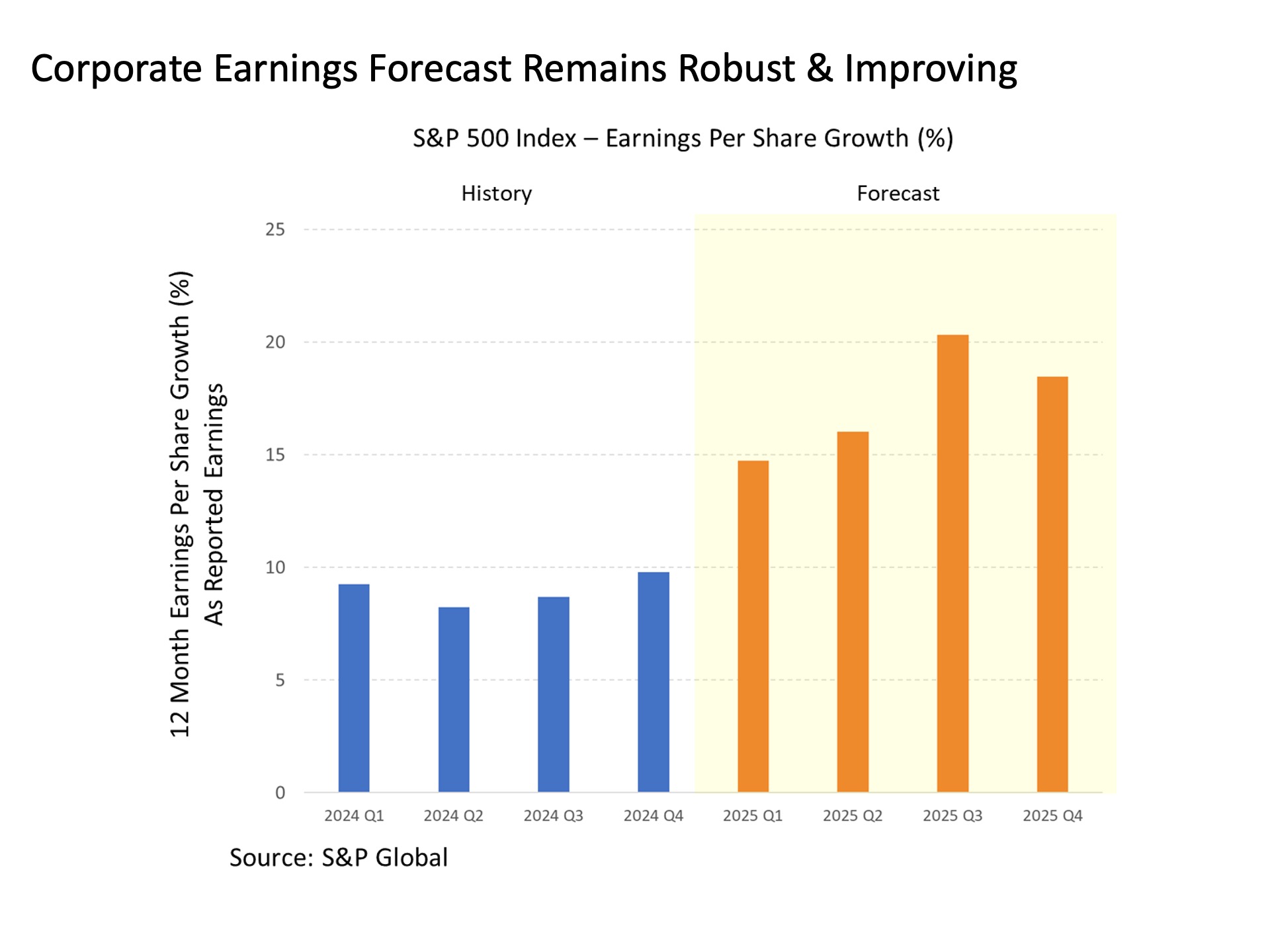

Let’s go one more for good measure. And for this closing song we will take a look at the latest forecast for S&P 500 corporate earnings. Is this based off of market prices? It is not, as it is instead based on the latest collective earnings forecasts from the companies that make up the S&P 500 Index. But since corporate earnings are the key factor upon which stock prices are based, it is still worth a closer look.

So where do we stand today on the corporate earnings front? They are currently forecasted to rise at a mid to high teens double digit rate throughout 2025, which is greater than the high single digit earnings growth rate we saw in 2024, which was a notably strong year for stock market returns. Perhaps more notably, corporations collectively have meaningfully increased their profit forecasts for the coming year amid all of the tariff news.

Bottom line. The financial news headlines remain inundated with the noise of tariffs. And this is likely to continue for the near-term future. Amid the noise, continue to be mindful of what expert pundits are saying and the associated potential downside risks. But when considering the related impact to your investment portfolio, stay focused on the longer term picture and listen to the music that market prices are playing.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

LPL Compliance Tracking #: 705678