The U.S. stock market is off to a roaring start in 2024. We are not even half way through the year yet, and the S&P 500 Index is higher by more than +15%. Sounds fantastic, right? It is definitely great news on a headline basis, but unfortunately all is not necessarily well with the broader stock market. A closer look underneath the surface reveals that the market is not nearly as healthy as the headline return might imply.

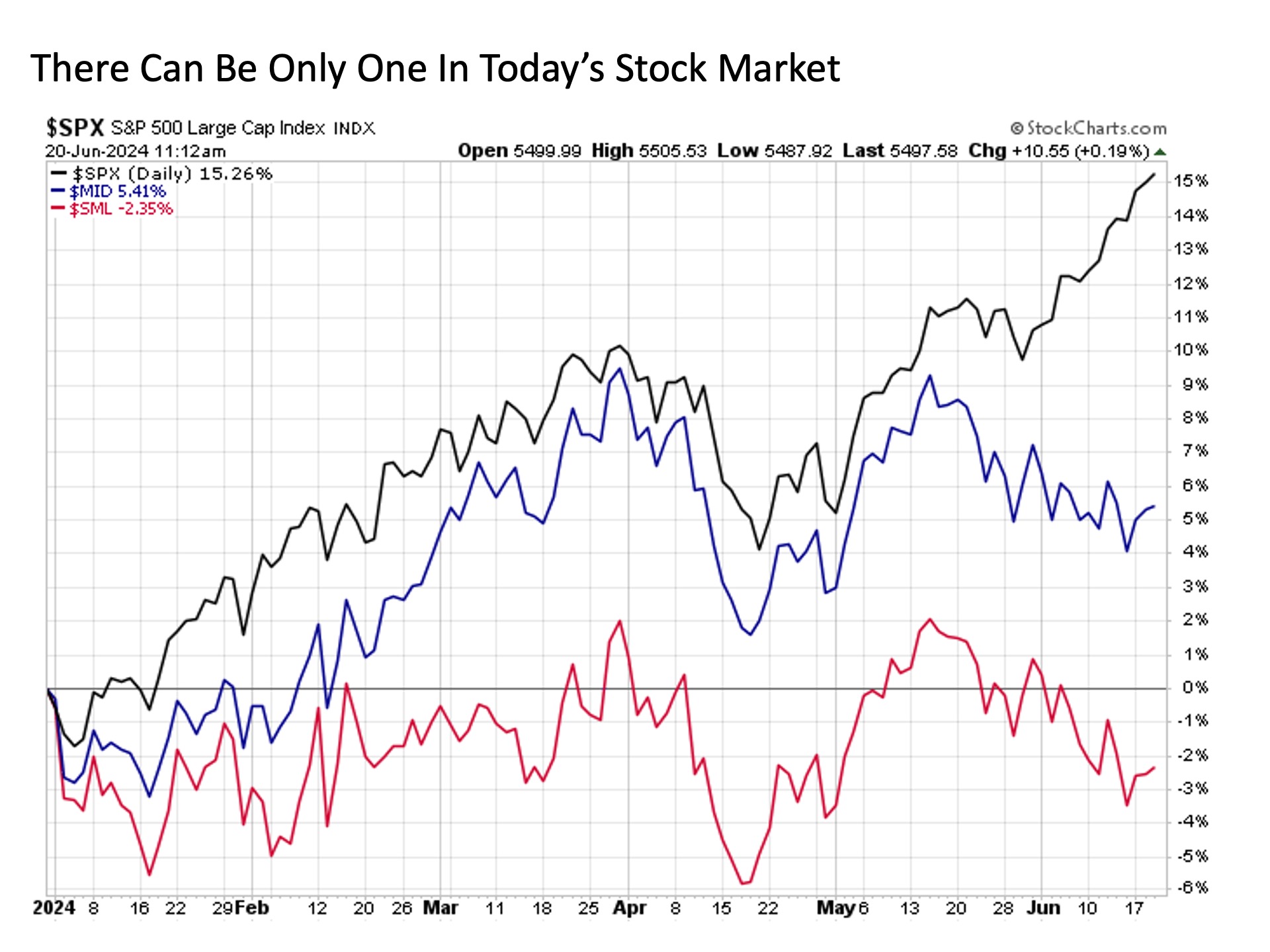

We’re one, but we’re not the same. Yes, the S&P 500 continues to rise at an epic rate, but it’s important to remember that the one U.S. stock market consists of many stocks that are vastly different from one another. One has to look no further than the chart below, which shows the cumulative return of the S&P 500 that focuses on the large cap area of the U.S. stock market versus the S&P 400 mid-cap and S&P 600 small cap indices. While the big stocks are soaring to the upside, we see mid-caps have tailed off markedly over the past month after keeping pace with large caps through the spring, while small-caps have effectively been dead money all year so far.

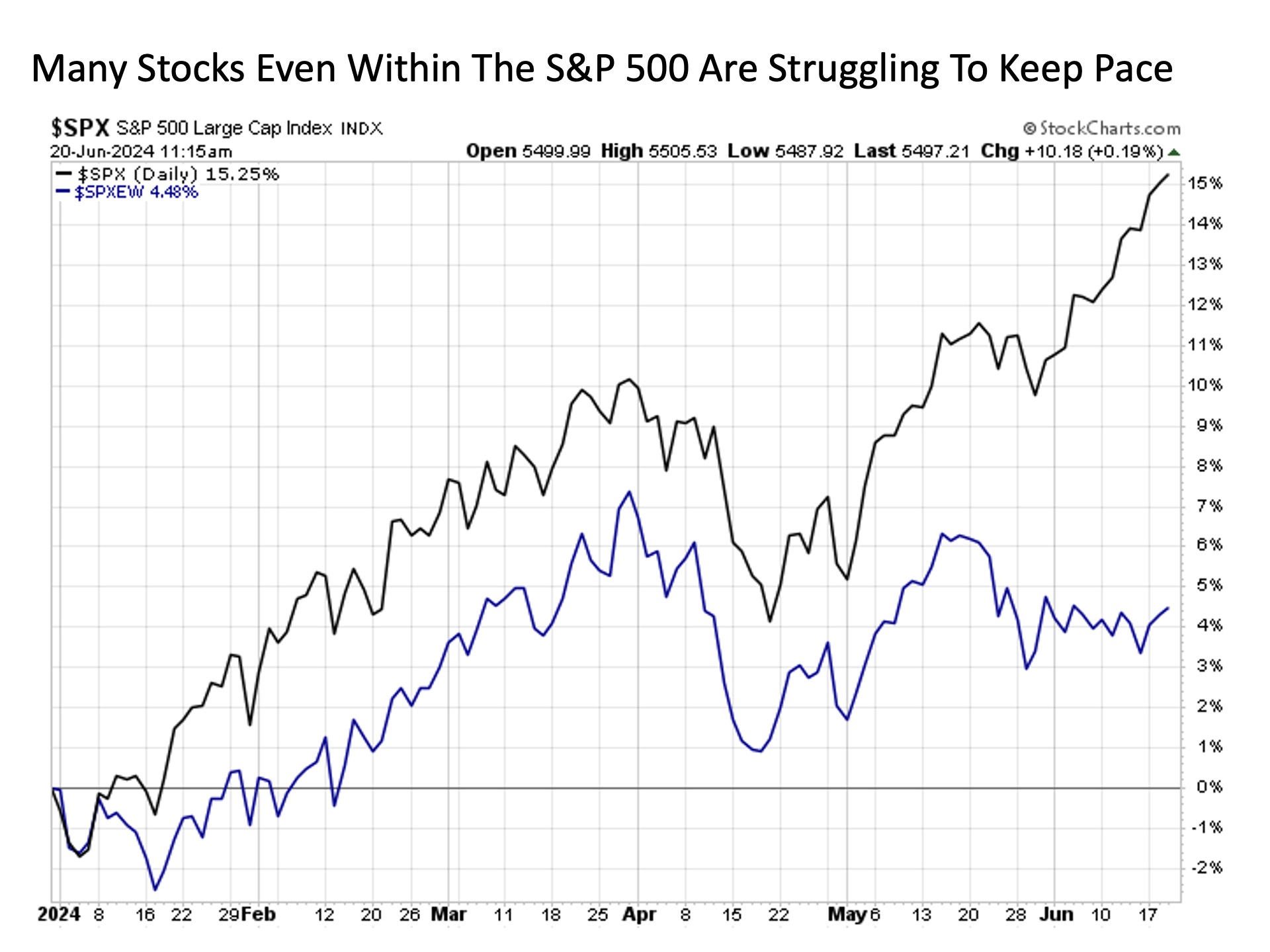

Let’s take this one step further and dig deeper into the U.S. large cap space itself. The S&P 500 is market cap weighted, which means that the largest companies in the index have the biggest impact on returns. For example, three companies alone – Microsoft, Apple, and NVIDIA – make up more than 21% of the entire weighting of the S&P 500 Index, with the remaining 79% spread across the remaining 497+ stocks in the index.

As a relative comparison, let’s see how the S&P 500 has performed year-to-date if we took each of stocks in the index and assigned an equal weight to each holding (i.e. essentially 0.2% to each stock in the benchmark). Remarkably, while the market cap weighted S&P 500 is higher by more than +15%, the same index equal weighted is only up less than 5%. Moreover, it is trading meaningfully lower today versus its previous peak from the end of March.

Deep down inside I feel to scream. The key takeaway is the following – something may not be right underneath the market surface. For while the S&P 500 is marching boldly higher, the vast majority of stocks with in the U.S. stock market are not necessarily sharing in this enthusiasm. This is what is known as narrowing market breadth, where a relatively few and decreasing number of stocks are driving the overall market higher.

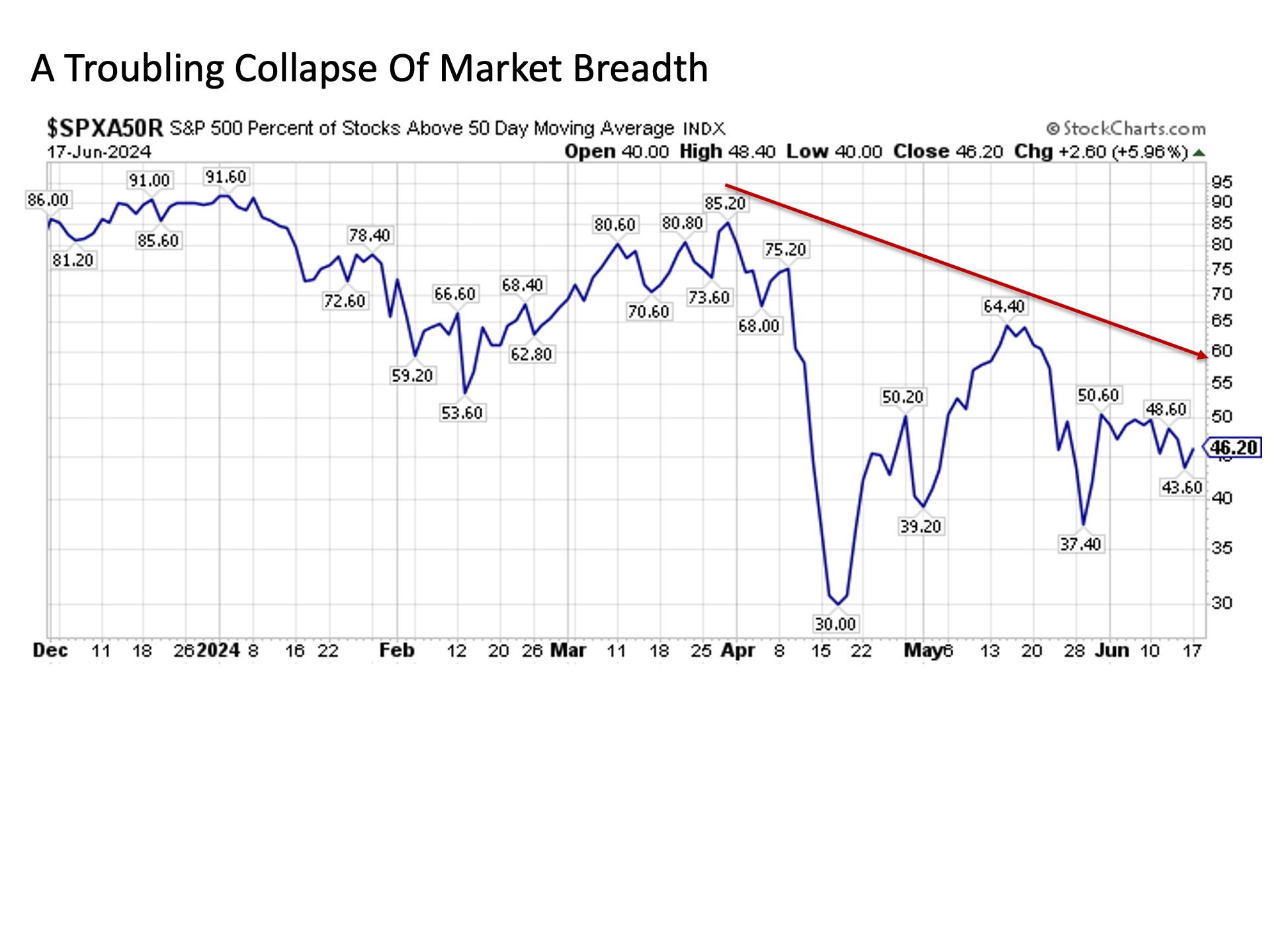

The chart above highlights this concept in more detail. At the end of March when the market previously peaked, more than 85% of stocks in the S&P 500 were trading above their respective 50-day moving averages. In other words, most stocks were participating in the broader market advance, thus broad market breadth. This is a good thing because if any specific stock in the group were to falter along the way, many other stocks are still rising to pick up the slack.

But over the course of the second quarter, we’ve seen marked narrowing of breadth. Today, despite the S&P 500 striking fresh new all-time highs, less than 50% of stocks within the index are trading above their respective 50-day moving averages. This is a potential problem, because if one of these remaining stocks that are driving the market higher steps on a proverbial landmine, a diminishing number of stock market solders remain to continue the market advance.

On the headline and core inflation front, the latest data looked particularly constructive. For the month of May, the annual headline inflation rate trimmed just over 10 basis points from 3.36% to 3.25%. As for the core inflation reading excluding the more volatile food and energy components, the steady downtrend continued as the annual rate hit a new post inflation cycle low of 3.41%, which was down more than 20 basis points from the previous month.

One is the loneliest number. Staying on the topic of narrowing breadth, we find that one particular stock more than any other is playing a disproportionately large part in carrying the broader S&P 500 to the upside. Rising just this week to become the largest company by market cap in the world at more than $3.4 trillion, NVIDIA alone accounts for more than 35% of the total return on the S&P 500 this year. In other words, take this one stock out of the market and suddenly the S&P 500 goes from being up more than +15% to gaining less than +10%. This is a disproportionately huge total return impact coming from just one stock across the entire market.

Again, this is great as long as NVIDIA continues to rise to the upside, but trading at more than 75 times earnings (earnings yield of just 1.27% versus a 10-Year Treasury yield north of 4.2%) and 41 times sales (broadly, a P/S ratio higher than 3 is considered expensive), even the greatest stocks in the world with incredibly compelling growth stories can have their limits (see Cisco Systems circa the year 2000).Every year, it’s the same and I feel it again. One final point to highlight on narrowing market breadth. Last year, the Magnificent Seven stocks of Microsoft, Apple, Amazon, NVIDIA, Alphabet (Google), Meta (Facebook), and Tesla led the charge as only 28% of stocks in the S&P 500 outperformed the index in 2023. This was considered remarkably narrow market breadth, as historically roughly 49% of stocks in the S&P 500 (essentially half) beat the market in any given year as would be reasonably expected.

Where do we stand today so far in 2024? After signs of broadening toward 40% in the first quarter of this year, today only 22% of stocks in the S&P 500 are leading the market year to date. This is measurably even more extreme narrow markets, which come with the increasingly commensurate risks as highlighted above.

Bottom line. Clearly, market breadth has narrowed significantly in the second quarter even as the S&P 500 continues to march to new all-time highs, and this comes with increasing risk.

The pessimist understandably might conclude that with fewer and fewer stocks driving the market to the upside, that eventually these remaining leaders will falter and a short-term correction in the range of -5% to -12% over a two week to eight week period on average could reasonably be expected. And if we were to see such a pullback come to pass as we move through the summer and into the fall, this would be a normal short-term pullback with a longer term upward moving bull market. In short, any such pullback should be anticipated at any given point in time as part of a normal healthy market.

The optimist, however, might take an alternate view. The economy remains strong, corporate earnings continue to increase at a double-digit annual rate, and stock valuations outside of the scorching hot tech sector remain historically reasonable if not outright attractive. As a result, it is also possible that the 79% of stocks that are currently trailing the market might eventually move to catch up.

In other words, a renewed broadening of market performance remains possible particularly given the underlying fundamentals and would be a welcome development in driving the next leg higher in the broader market.

Whether the pessimist or optimistic view prevails will be a worthwhile development to watch as we move through the summer months.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 594257-1