Capital markets had a rousing day on Wednesday. Not only are the initial earnings reports from the nation’s leading banks coming in strong, but a better-than-expected reading on inflation for December sent both stocks and bonds surging to the upside. But Wednesday was a rare moment of warmth in what has otherwise been a cold and dreary winter so far for investors. Is the worst of the recent pullback now behind us, or is further downside in store in the weeks ahead?

Winter came early this year. Traditionally, it is the most wonderful time of year for stock investors. After surging almost continuously to the upside for more than a year since Halloween 2023, U.S. stocks were set to cap off a great 2024 by storming through one of the most consistent upside returning months of the year in December. Santa Claus rally, here we come!

In the end, it was not to be. For only the fifth time since the start of the new millennium, the U.S. stock market traded lower for December. And the downside pressure has continued into the New Year.

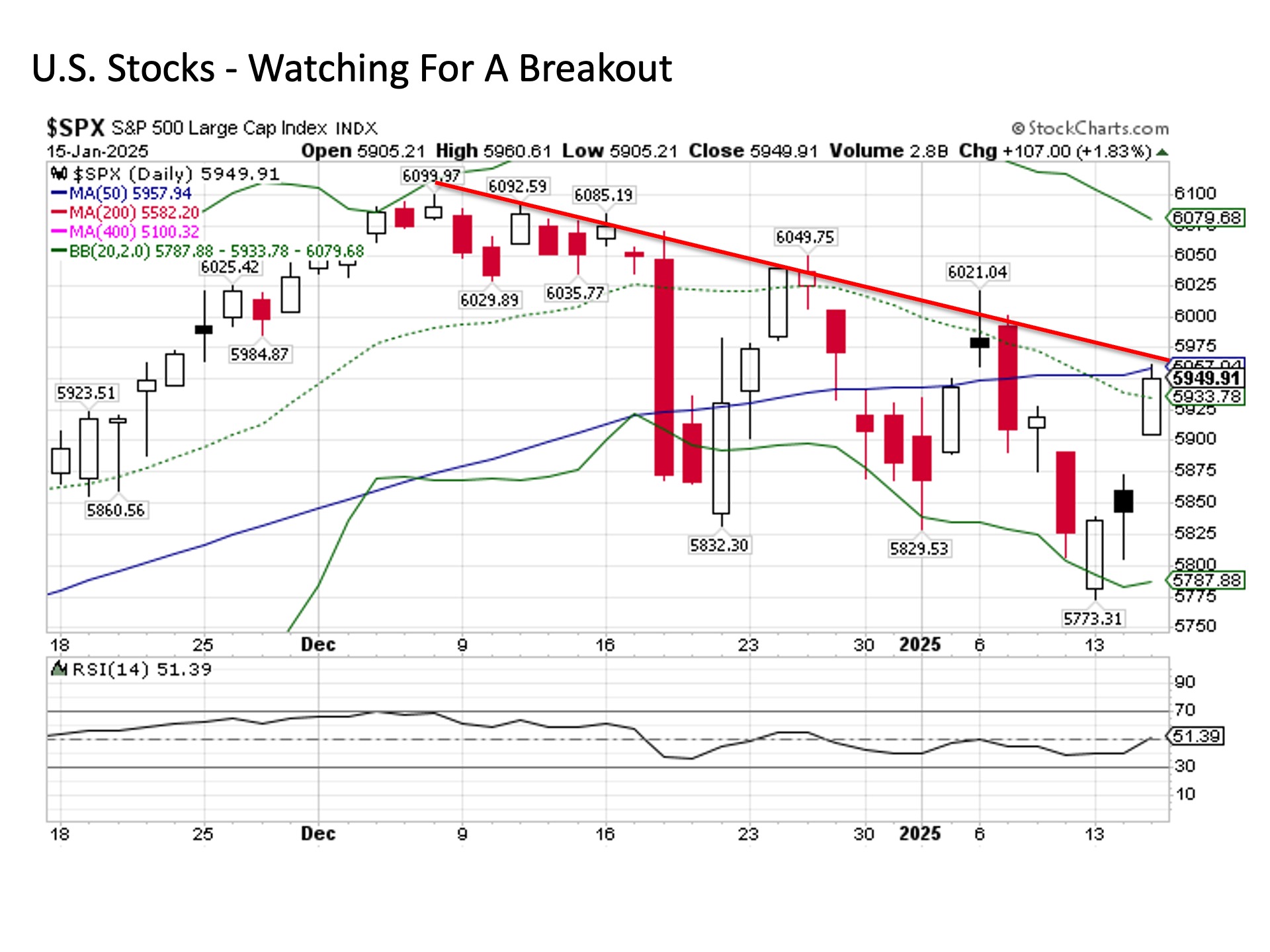

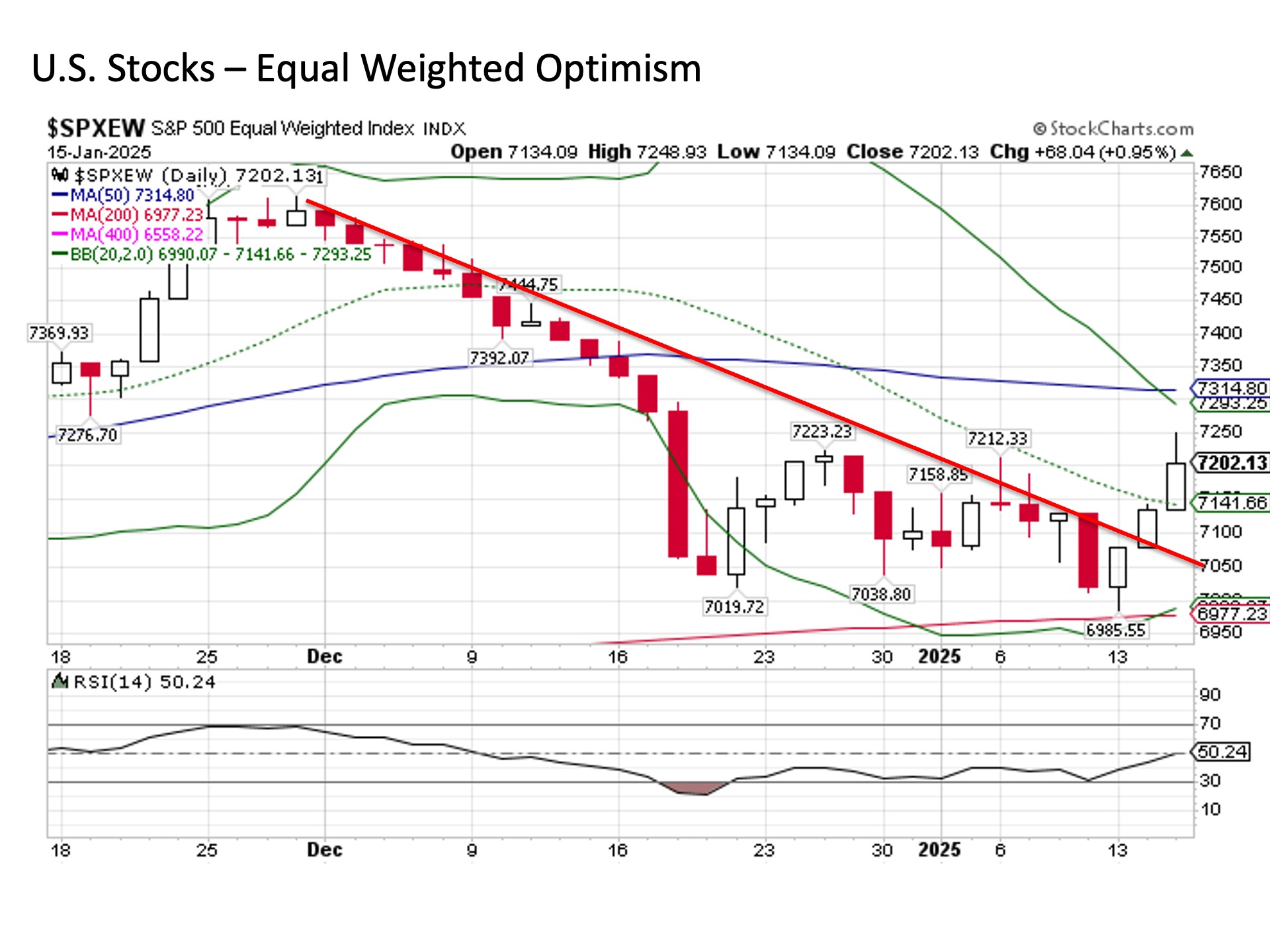

At first glance, the chart above does not look so bad. The market managed to push to the upside for a couple of weeks into December before relenting with a downside slide. But a closer look underneath the hood at a broader range of stocks reveals the magnitude of the recent downside pressure. For example, one has to look no further than the S&P 500 index itself and its equal weighted counterpart. No sooner did December get underway and stocks more broadly were moving relentlessly to the downside.

So what has been behind this sell off to date?

First, a pullback in stocks has been long overdue. Stocks typically do not go up in a straight line, but that is what had been effectively happening dating back to late 2023 save fleeting declines in April and July. Conditions had become overbought and a bit frothy in certain pockets of the equity market, so skimming the foam off the top of the stock market has arguably been a healthy thing in recent weeks.

Next, worries about a renewed surge in inflation have also weighed. Only a few months ago in September, the narrative focused on the looming threat of recession coming in 2025 and the Federal Reserve, buoyed by fading inflationary pressures, was poised to come to the rescue with long anticipated interest rate cuts. Fast forward only a few months later, however, and the theme had shifted sharply to a persistently strong economy with stubborn inflation pressures that threatened to ignite anew with the kindling of anticipated tariffs and pro-growth fiscal policies. What a difference a couple of months make, as it helps to explain why U.S. Treasury yields have been surging to the upside for much of the last four months now.

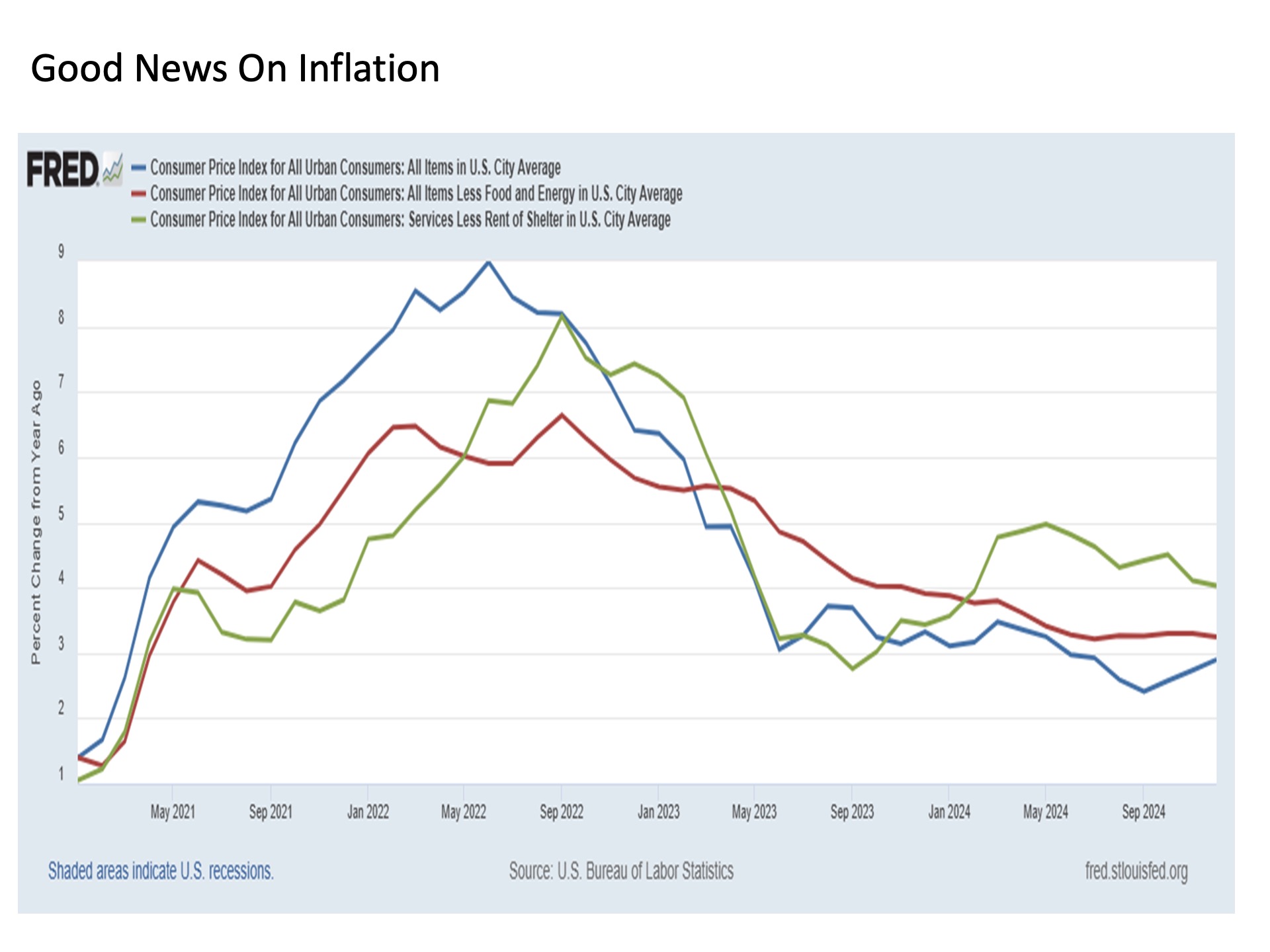

The price is right. Clearly, the latest reading on inflation came as welcome news given the pricing pressures overhanging the markets in recent weeks. Although the headline Consumer Price Index actually pushed higher toward 2.9% on a year-over-year basis in December, the fact that the more stable Core CPI edged lower to 3.2% and recently stickier services inflation also cooled further on an annual basis was more than enough to send both the stock and bond markets cheering.

The price may not yet be right. Despite the strong market response on Wednesday, the stock market may not yet be out of the pullback woods.

First, it is important to note that while economic data in any given month is based on estimates and seasonal adjustments, it should be noted that the December data is particularly noisy in any given year. This is due to any number of reasons including forces related to the holiday season and the timing of when Thanksgiving and Christmas fall on the calendar. Thus, while the latest CPI readings were certainly positive, we’ll need to see how the data comes out for January and February before we can draw any meaningful conclusions.

Second, while the Treasury bond market rallied bigly on Wednesday following the inflation news, it is still only the first bounce in a while in a market that up until recently was moving chronically higher in yields for weeks now. Seeing more sustained follow through to the downside in Treasury yields will be important in the coming days and weeks. Otherwise, the ever shrinking equity risk premium is likely to present an increasing problem for stocks.

Third and speaking of stocks, while the rally in the S&P 500 has been impressive throughout the week including Wednesday, it should be noted that the headline index has only now returned to the convergence of several key resistance levels. This includes its short-term 20-day moving average (green dotted line in chart below), its medium-term 50-day moving average (blue line in chart below), and its downward sloping trendline dating back to the end of November. It will be critical to see whether the S&P 500 can advance beyond these various key resistance levels.

Fourth and supporting the idea that stocks may have the power to break out to the upside, the S&P 500 equal weighted index is providing constructive signals. Not only has it already broken out above its downward sloping trendline since Thanksgiving, it has also advanced above its short-term 20-day moving average. In a potentially notable change in roles, the equal weighted index may be leading its market cap weighted counterpart out of the pullback woods.

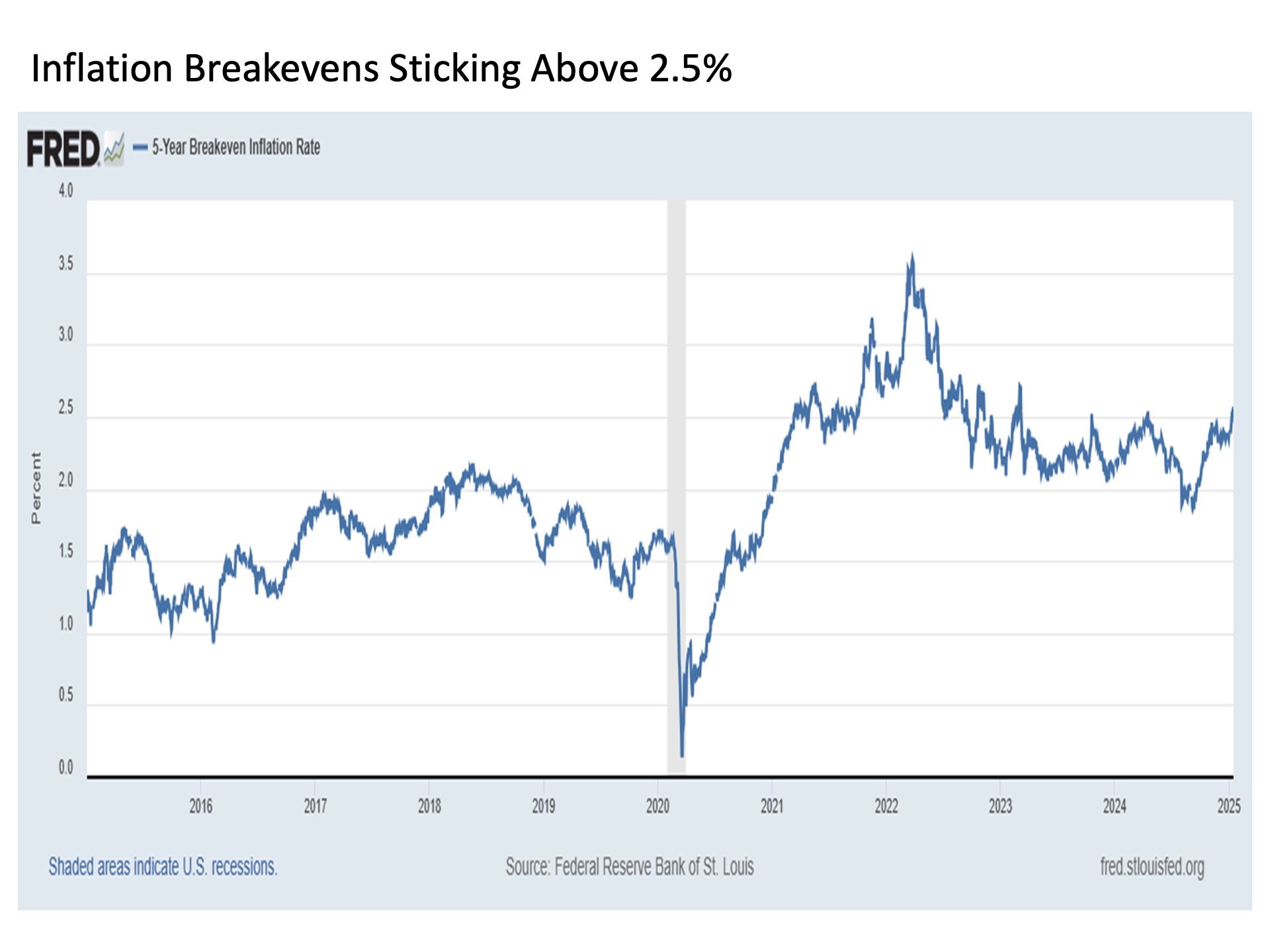

Lastly, investors should be prepared for the inflation outlook ahead. Notably, the 5-year breakeven inflation rate that measures the average expected inflation over the next five years remained above 2.50% on Wednesday despite the positive CPI news.

In addition, we cannot overlook the potential economic implications of the tragedy that continues to unfold in and around the second largest metropolitan area in the U.S. in Los Angeles. It is estimated that more than 12,000 buildings and automobiles have been destroyed by the fires to date. This damage will need to be replaced, and such forces are inherently inflationary all else equal. As a result, we should be braced for the potential for stronger than expected inflation readings in the months ahead as rebuilding and replacement begins.

Bottom line. The stock market has been in pullback since Thanksgiving. While the recent news on inflation may be supporting the potential bottoming of the market, we are not yet clear in resuming the advance to the upside. Further upside will be important in the coming days in transitioning this recent bounce into a full-fledged bottom instead of a fleeting bounce. Stay tuned.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 683760