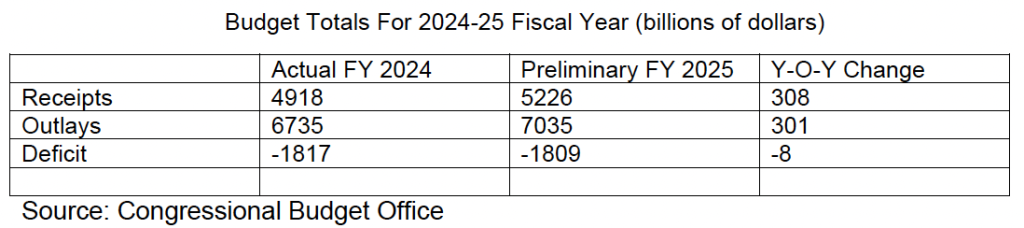

Our August commentary showing the projected growth in the federal government’s debt generated a perceptive question from one of our readers: how much would the new tariff regime improve the deficit picture? After all, the Congressional Budget Office estimates were compiled prior to the imposition of increased customs duties this spring and summer—what if we take the increased government revenues into account?

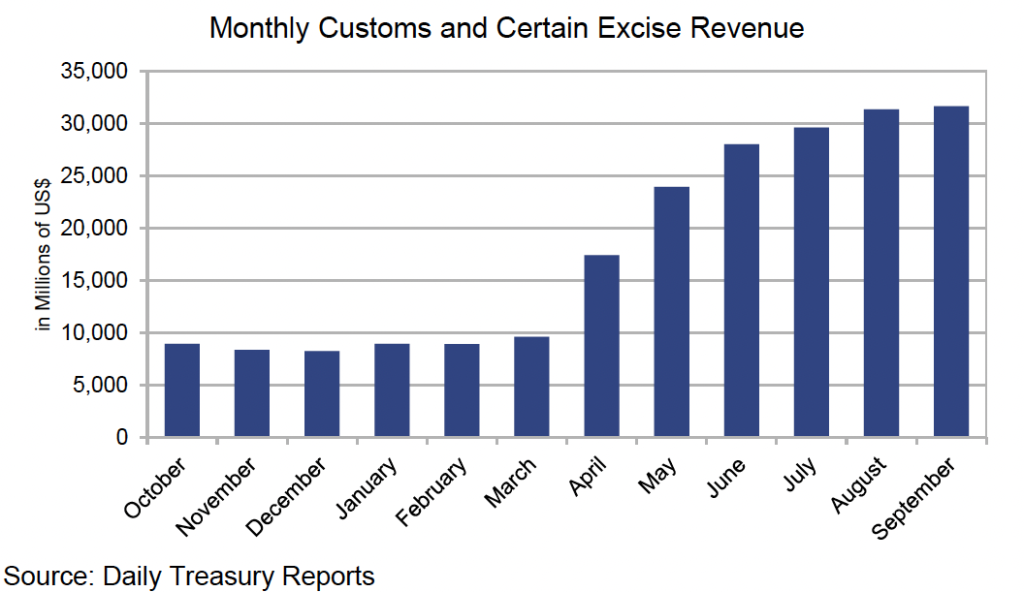

Defining Washington’s tariff income for the next ten years is a thankless task, given the lack of clarity regarding both the current and future administrations’ policies, along with other countries’ attempts to circumvent them. However, we do have a few months of data from the Daily Treasury Report to offer a tenuous foothold for an estimate, if we assume that the current levels will project into the future.

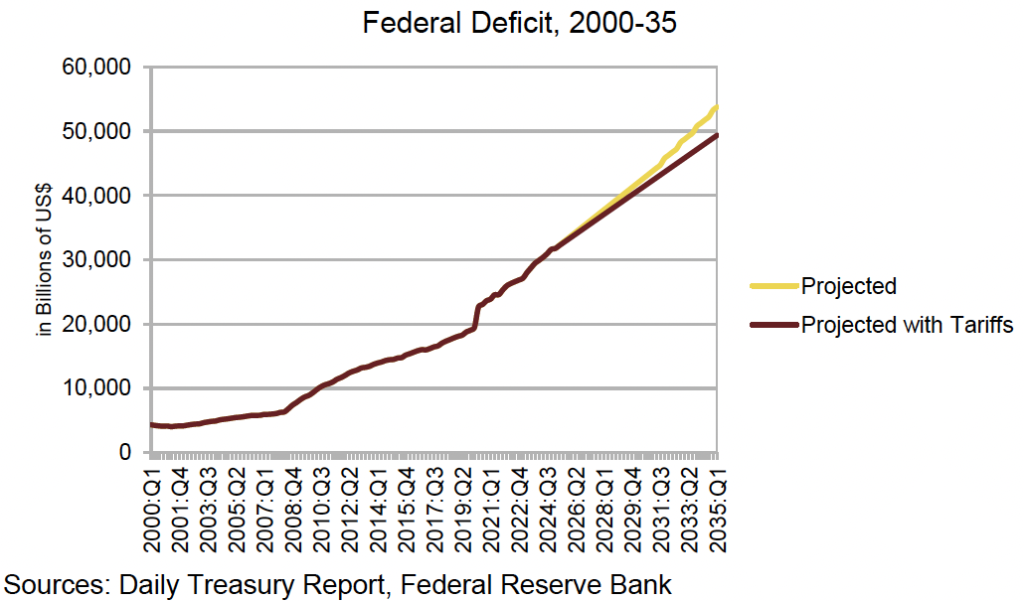

As you can see, the monthly Customs revenue seems to have leveled off at just over $30 billion per month, and, if we subtract the roughly $8 billion previously collected, we arrive at $22 billion per month or an estimated $250 billion annually in additional revenue. Assuming all other spending and revenue remaining unchanged from their predicted values, the next ten years of deficit would look like this.

As you can see, the effect of an extra quarter-trillion dollars per year on the trajectory of the debt is minimal—and that’s before taking into account the spending which is being bandied about as an offset to tariff costs, like a bailout of soybean farmers or “trade dividend” checks to taxpayers. While import duties may deflect the trajectory of the debt curve slightly, in their current form they will not produce any substantial transformation of the fiscal situation.

Workin’ for the Man

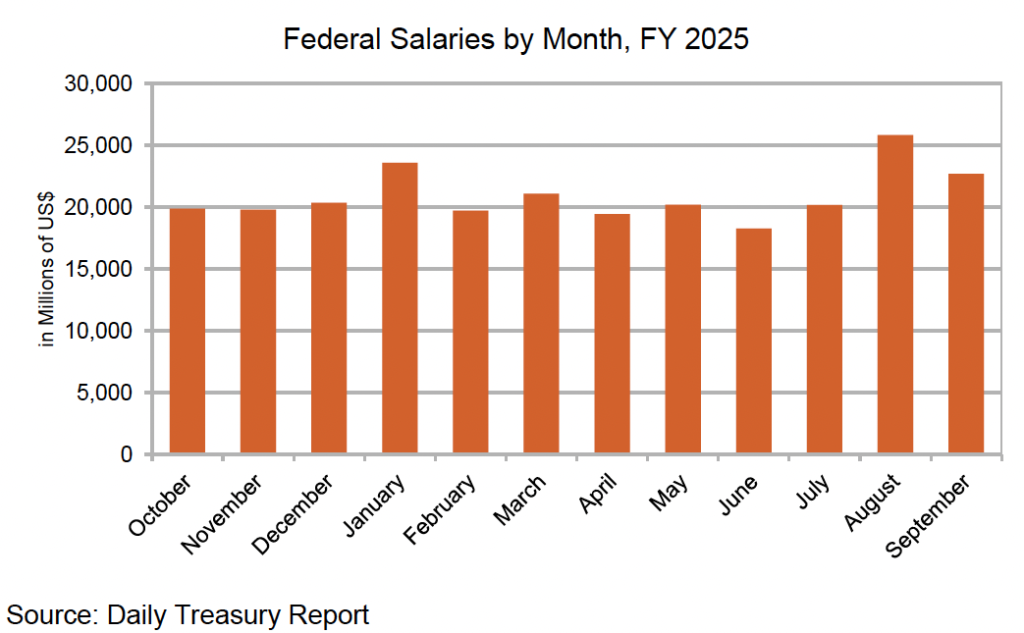

While tariffs have been been the most prominent economic policy of the new administration, the attempted harrowing of the federal workforce has also been much in the news. However, despite pronouncements to the contrary, to date the cost of the federal bureaucracy (as determined from our trusty Daily Treasury Report) has not shown much if any change. This is not to suggest that program and employee cuts have not been meaningful or painful, only that Washington doesn’t seem to be paying any less for what might be presumed to be worse services.

Of course, there are even more changes in the federal workforce underway right now, and we hope to revisit this chart after the shutdown ends to see what that standoff has wrought.

All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All performance referenced is historical and is no guarantee of future results. The content is developed from sources believed to be providing accurate information.

Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Great Valley Advisor Group, a Registered Investment Advisor. Great Valley Advisor Group and Doylestown Wealth Management, Inc. are separate entities from LPL Financial.