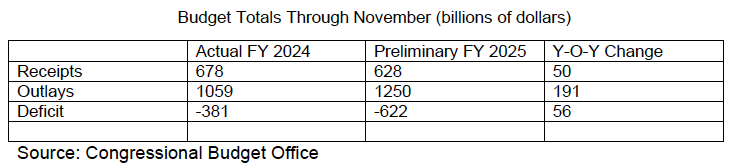

Some of you probably thought we were kidding when we suggested that the first approximation revenue raise from a 20% across-the-board tariff would only amount to two months worth of deficit. But by the beginning of December the federal government had already spent $600 billion more than it took in—pretty much what we estimated the proposed tariff would produce annually (all other things being equal). (We should note that a calendar shift pushed about $100 billion of Medicare spending into November, so the comparison to last year is exaggerated, but still, in these two months one can see the challenges.)

Sympathy for the Deficit

Some of you may remember a financial author and pundit named Harry Dent, who made his name by using demographic trends to predict the bull run of the late nineties in his books The Great Boom Ahead (1993) and the Roaring 2000’s (1998). To paraphrase his argument, Dent analyzed consumer spending patterns based on age to predict that the Baby Boomers would drive economic expansion in their prime spending years, becoming a well-known author and sought-out financial speaker as a result. Dent took a much dimmer view of prospects as the Boomers began to retire, penning such missives as The Great Depression Ahead (2009), The Great Crash Ahead (2011), and The Demographic Cliff: How to Survive and Prosper During the Great Deflation of 2014-2019 (2014). These prognostications have proven a bit wide of the mark, and his popularity has waned in the ensuing years.

We have chosen Harvey Dent because many of you might recall his name, but he was far from alone in his predictions that the demographic “pig through the python” would dampen Americans’ willingness to take on debt. And he was not wrong about that. Household debt stagnated for 9 years from 2007 to 2016 and has only risen at a sluggish pace ever since. But what demographic trends could not predict was the degree to which federal deficit spending would take over from households—and to a large extent businesses—during the last fifteen years.

From 2007 to 2020, the federal debt increased by more than the entire stock of household debt outstanding! It will finish 2024 at about $30 trillion (the Fed does not include intragovernmental debt in its figures).

From the chart above you can see that the federal deficit was vital in avoiding a demographic-led crash in the 2010’s. Washington’s loose pockets were also essential in staving off economic disaster during COVID. This accords with the maxims of John Maynard Keynes, who suggested that governments ought to run deficits to head off economic downturns. The question then becomes can we ever shift back to a more “normal” system, where borrowing by households and businesses drives expansion while federal debt stagnates—a situation most people would view as more desirable.

So the federal deficit—scapegoated and derided on all sides—has kept the economy rolling for the last fifteen years. Whether or not the money has been spent wisely is a question which we cannot answer here, but spent it has been, and the persistent rise in asset prices and corporate profits owes its force to it. We should not forget that the federal budget is a profit center for corporate America—a steady and non-price conscious purchaser of goods and services. The Treasury has a giant pot of money, and success in American business depends greatly on picking up some of it.

Lately, there has been much talk of spending cuts and efficiency drives in the federal budget. While the spectacle of billionaire trolls pushing Beltway bureaucrats into the street may occasion mirth in some circles, we are doubtful it will result in significantly reduced spending.. Government “efficiency” drives usually wind up outsourcing the work, which almost inevitably requires oversight—the net effect of which is to spend more money for the same function, not to mention the gamification of the system by the contractors. An example which we may consider in more detail at a later date is the so-called Medicare Advantage. Created to “make Medicare more efficient” the program now costs more per patient than traditional Medicare, with the extra money going to the health insurance/PBM/medical practices conglomerates. Whether or not turning over a government function to private enterprise is desirable depends on your view of private enterprise. One must have a great deal of faith in the altruistic nature of people who are programmed to maximize returns to think that they will restrain themselves.

We would be the last to deny that there is fat to be cut in the federal government’s operations. However, significant spending reductions (as opposed to headline-grabbing tweets) would need to come from the highest spending sectors of defense/homeland security and Medicare/Medicaid/VA—which just happen to be the drivers of the two main growth sectors of the market—tech and health care. Until this happens we will view the efforts as punitive and politically-motivated rather than a serious attempt to reduce the deficit.

A Rant Deferred

Recently, we read about a survey which reported that three-quarters of Generation X felt that the politicians had no idea how to fix Social Security. In reality, Social Security is the easiest government program of all to fix—all it takes is money, and not really all that much of it either ($100 billion annually for the next ten years). The feigned helplessness of the political and financial elite combined with the utter cluelessness of the American public can drive one to despair! But we will reserve our invective until after the Christmas season.

All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All performance referenced is historical and is no guarantee of future results.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

The content is developed from sources believed to be providing accurate information.

Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Great Valley Advisor Group, a Registered Investment Advisor. Great Valley Advisor Group and Doylestown Wealth Management, Inc. are separate entities from LPL Financial.