Let’s Not Kid Ourselves

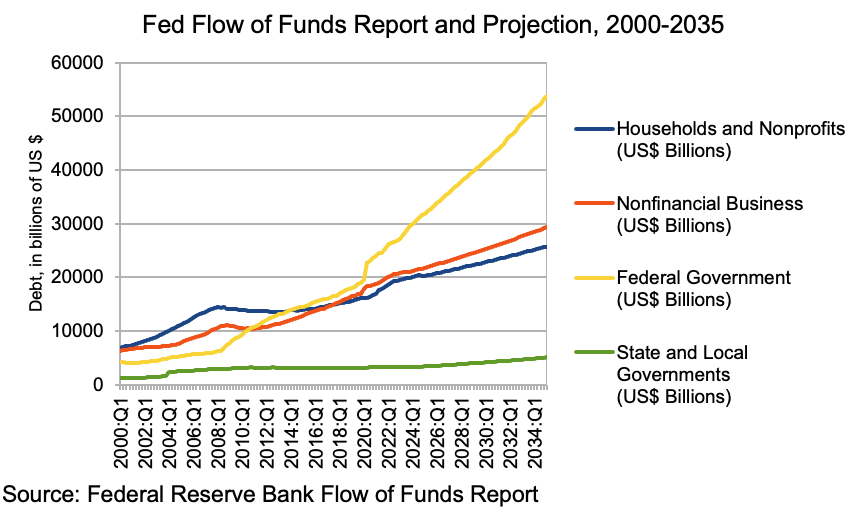

The Federal Reserve Bank best known for setting overnight interest rates, but its often overlooked statistical work includes compiling data on the nation’s financial conditions. One useful report is the quarterly Flow of Funds, which tallies the debt owed by American households, businesses, and governments.

We have projected borrowings over the next ten years based on recent growth rates, with the exception of the federal government, which is derived from Congressional Budget Office estimates. The rise of federal debt above both household and business borrowing since the turn of the century is clear, and if current trends continue it will continue to extend its lead in the coming decade. In fact, by 2035, federal debt is slated to become almost equal to the sum of business and household debt—a mere thirty five years after being less than either of them. And the chart if anything understates the future debt trends because it assumes no financial or societal crises in the next decade. Crises tend to ramp up federal debt creation while repressing household and business debt increases—evinced most clearly in the aftermath of 2008 and to a lesser extent in the reaction to COVID. In other words, the chart above is probably a best case; any problems would make the outsized growth of federal debt even more prominent.

In short, the foreseeable future will see the increasing importance of the federal budget in the economic well-being of the nation (and the world). Ironically, this reliance on government deficit spending to keep the American economy moving forward stands in stark contrast to the prevailing ideology in Washington and in the financial press. Certainly no one wants to admit that continued $2 trillion annual deficits are the lifeblood of continued economic growth.

Note that we are not suggesting that the unimpeded growth in federal debt will in and of itself lead to a financial crisis. As we have discussed many times, the United States Treasury is a unique class of debtor, one which can (in partnership with the Federal Reserve) set its own interest rates, on the short maturities by dictating the overnight rate and on the long maturities through bond purchases by the central bank—euphemistically known as Quantitative Easing, or QE. As a last measure, the United States government could issue its own money—most likely a digital currency—to pay its bills. While this step would be inadvisable under ordinary circumstances because of the price inflation which would almost certainly ensue, it is important to remember that Washington has the option of simply creating and issuing money, and therefore no amount of debt will a priori precipitate a crisis.

But the fact that the US government cannot be forced to alter its budget because of a debt crisis does not mean that all is well. Finite sums of money focus and discipline spending in a way that black checks do not. We have pointed out previously that having lots of money to spend can actually be detrimental to getting anything done (as in the case of the icebreakers). Just because the federal government can spend money doesn’t mean that any end product will be forthcoming, indeed, the focus soon shifts towards drawing the project out to the benefit of those employed in it. It also allows money to be wasted on obsolete and ineffective products and methods which are often worse than simply distractions. We could cite many examples of weapons systems which recent conflicts have shown to be anachronistic but are still fully funded. Also, large and poorly guarded sums of money attract grifters and looters like flies to honey. When dishonesty pays much better than honest work, the former will expand at the expense of the latter.

The continued acceptance of enormous credit creation by Washington allows for all of the ills of Big Government that the conservatives now in the ascendancy have been railing against ever since the New Deal. Perhaps the political and financial players and opinion makers have become numb to Irony; this commentary has not.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

The content is developed from sources believed to be providing accurate information.

Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Great Valley Advisor Group, a Registered Investment Advisor. Great Valley Advisor Group and Doylestown Wealth Management, Inc. are separate entities from LPL Financial.